Risk and Volatility.

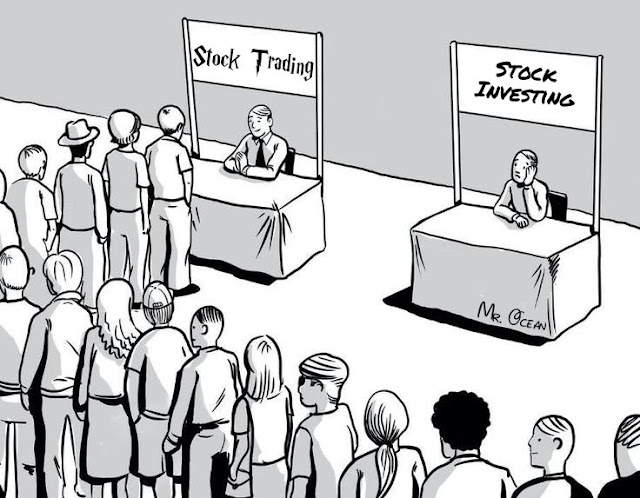

Investors generally say they are risk-averse as far as financial matters are concerned, but are they? But the thing is, how do they calculate the risk of their portfolio, in which they have employed their hard-earned capital? Generally, investors are lured by high and moderate returns in this asset management industry, but investors forget that with high returns of outcomes, it possesses high risk, which is uncalculated many times. On the other hand, investors observe the fund management history or track the fund manager's style for high returns, but those facts are based on past results. Stakeholders at large mostly forget the future prospects of their investments, as God knows where they will go. As per research as of now, out of total asset management companies in India, only 32.13% have generated returns greater than the NIFTY Index. It means investors pay higher commissions to fund managers for more than 67% of these companies. For instance, if your fund manager cannot give yo...